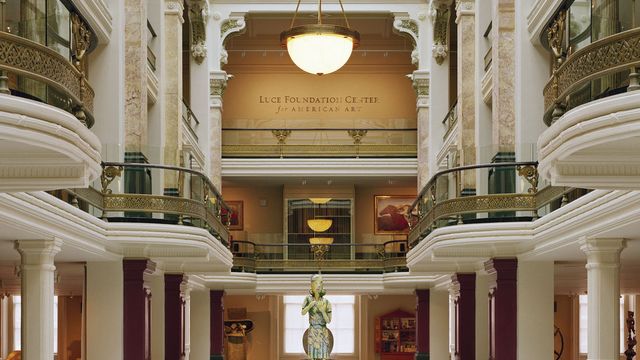

Planned giving is a meaningful way to create a legacy at the Smithsonian American Art Museum while taking advantage of income and tax benefits for you and your heirs. Choosing to participate in any of the following planned giving vehicles will help ensure that millions of people across the nation will continue to enjoy our cultural heritage through America’s finest artworks.

For more information, please contact:

Michelle Atkins

We are happy to work with you to explore creative giving opportunities that meet your financial and estate planning needs.

Charitable Gift Annuities

“In Giving, You Receive.”

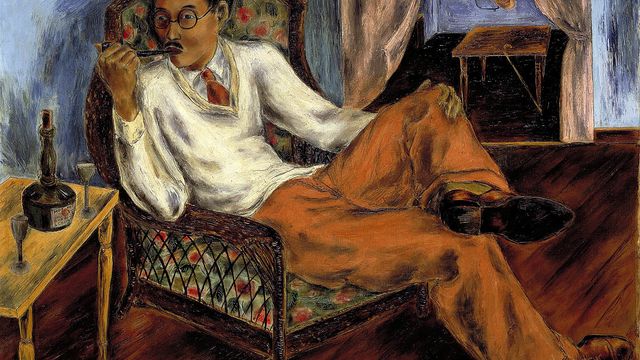

Charles lives in New York City with his wife Judith. Their mutual love of art led them to many years of volunteer service at the Smithsonian American Art Museum and fired their enthusiasm for American art. Their charitable gift annuity allows them to receive income and upon Charles’s death, the remaining principal will benefit the museum.

If you are tired of living at the mercy of the fluctuating stock and real estate markets and you are looking for secure sources of fixed income for now or future retirement, supporting the Smithsonian American Art Museum with a charitable gift annuity can be a win-win proposition.

A charitable gift annuity provides you with a guaranteed income for life and you will receive a charitable deduction for the value of your future gift to the museum. No matter the size, your gift will help us present a dazzling showcase of American art for generations to come.

You can establish a charitable gift annuity, which is a simple contract between you and the Smithsonian, for a minimum gift of $10,000 using cash or securities. In return, you secure a fixed income for the life of one or two individuals, part of which is tax-free. The specific rate of income is based on the age of the donor.

Charitable Remainder Trusts

“The friends I have gained at the Smithsonian far exceed my giving.”

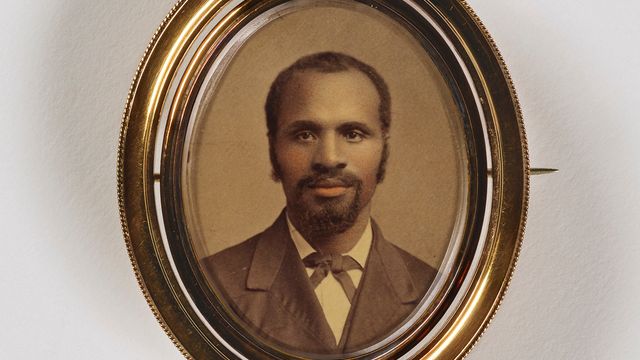

Bernie was a longtime friend of the Smithsonian and a photography enthusiast. Always carrying a camera around his neck, Bernie began shooting pictures when he served in the Navy on the carrier U.S.S. Midway during the Korean War. He operated a photo studio in New York City during the 1950s, and a later built a succesful hobby shop business in High Point, North Carolina.

Several years ago when making out his will, Bernie decided to support the photography collection of the American Art Museum in a significant way. He converted business assets into two charitable trusts, and made the museum the beneficiary of his entire estate. His legacy will enhance the Museum’s collection of American photography and support its exhibition.

There are two types of Charitable Remainder Trusts: Charitable Remainder Unitrusts and Charitable Remainder Annuity Trusts.

A charitable remainder unitrust allows you to make a significant gift while retaining income from the property for yourself or another designee. The amount you receive as a life income is a fixed percentage of the trusts market value each year. You fund a unitrust with assets such as appreciated property or stocks which generate the greatest net savings for you. You are allowed an income tax deduction upon establishing the trust, based on the actuarially determined value of the charity’s remainder interest. After your lifetime the principal of the trust is turned over to the Museum for use as you specified. A unitrust is a useful way to generate tax savings during your income-earning years and supplemental income after retirement.

Your annual income from a charitable remainder annuity trust never varies. This trust is similar to the charitable remainder unitrust, with the exception that this plan will pay you a fixed dollar amount each year for the rest of your life. At the outset, you decide the amount to be paid to you each year from the trust. You will receive payments from the trust assets, and it will be the same amount each year, regardless of changing interest rates and stock market fluctuations.

Bequests

The Smithsonian American Art Museum’s existence is attributed to the power of bequests.

Harriet Lane Johnston, the niece of James Buchanan and official hostess of the White House during his presidency, bequeathed her art collection in 1903 and focused the Smithsonian on collecting art as part of its comprehensive mission and created the basis of the Museum’s collection.

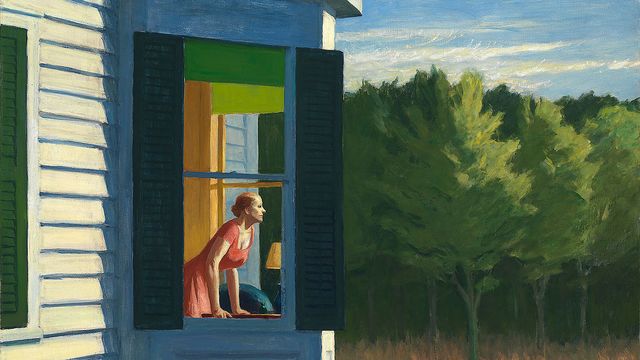

Since then the museum has received significant support in the form of bequests both large and small. Arthur J. and Edith Levin, of Palo Alto, California, were passionate about art and long-time devotees of the Museum. In addition to a generous estate gift providing funds for acquisitions and programs, their bequest of 140 artworks includes major works by California modern and contemporary artists.

Legacy donors have found that bequests are a way to perpetuate the values and ideals that have been important in their lives. No matter the size, legacy gifts will help present a dazzling showcase of American art for generations to come. Including the museum in your estate plans is a great way to preserve your cultural values for the next generation.

Retirement Plan Assets

“When someone supports a museum, she helps educate the world.”

Karen is a professor of English literature and art history. She is creating a legacy at the Smithsonian American Art Museum.

She says, “I’ve made a gift in my will to the Museum dedicating half of my retirement account for the purchase and care of artworks for the museum’s permanent collection.”

After a lifetime as an educator, Karen’s bequest will perpetuate the values and ideas that are important to her. In her teaching she emphasizes the full story of American art from the Hudson River School to modern art which doesn’t get as much emphasis in world art history texts. She loves modern art as well as the American illustrators. Her spare time is often devoted to historical and local art museums. She says of her gift, “When someone supports a museum, she helps educate the world.”

Including the museum in your estate plans is a great way to preserve your cultural values for the next generation.

Life Insurance Proceeds

Do you have an existing life insurance policy which is no longer needed or your circumstances have changed?

A life insurance policy can be an excellent tool for making a gift to support the work of the Smithsonian American Art Museum. A gift can be accomplished simply by making the Museum the beneficiary of an existing policy. The Museum would then receive the proceeds of the policy after the covered party’s lifetime.